向各类交易者开放

名称

最新价格

最新价格(USD)

24小时涨跌

24小时交易量

Deribit交易平台

加密货币期权行业领导者。

创建于2016年。

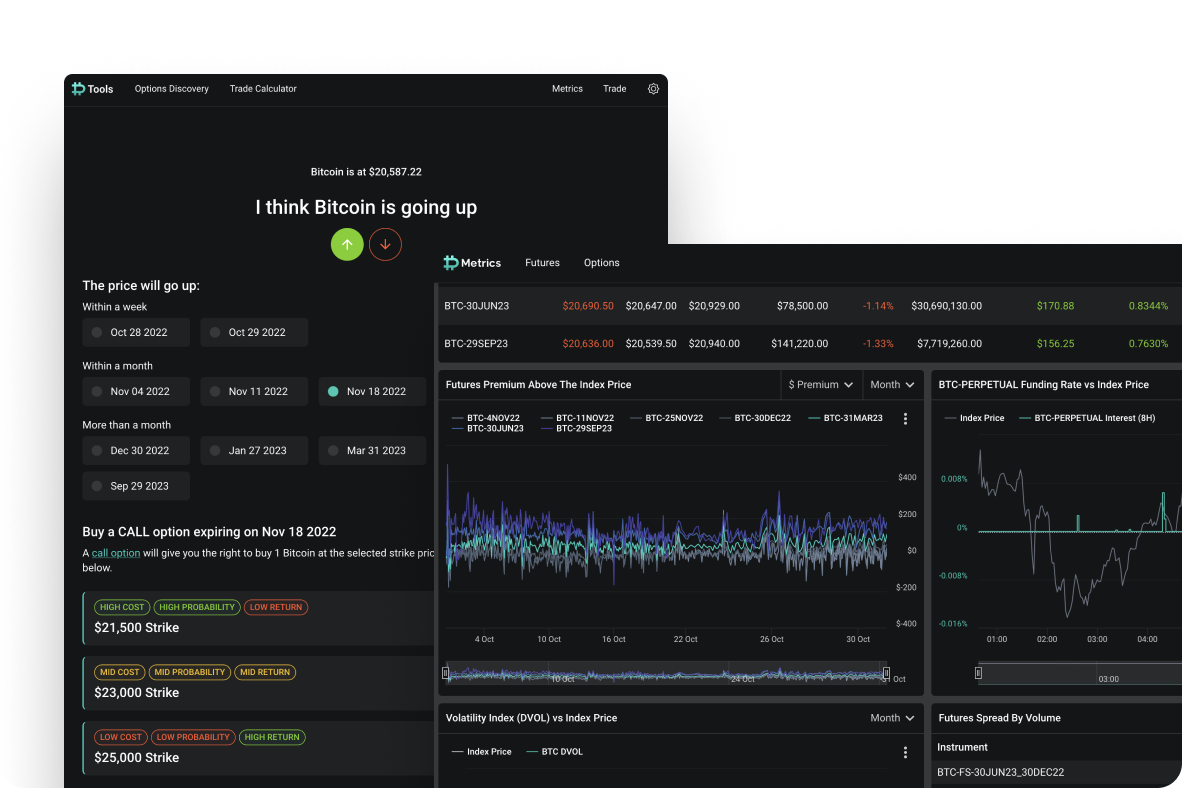

适用于初学者。

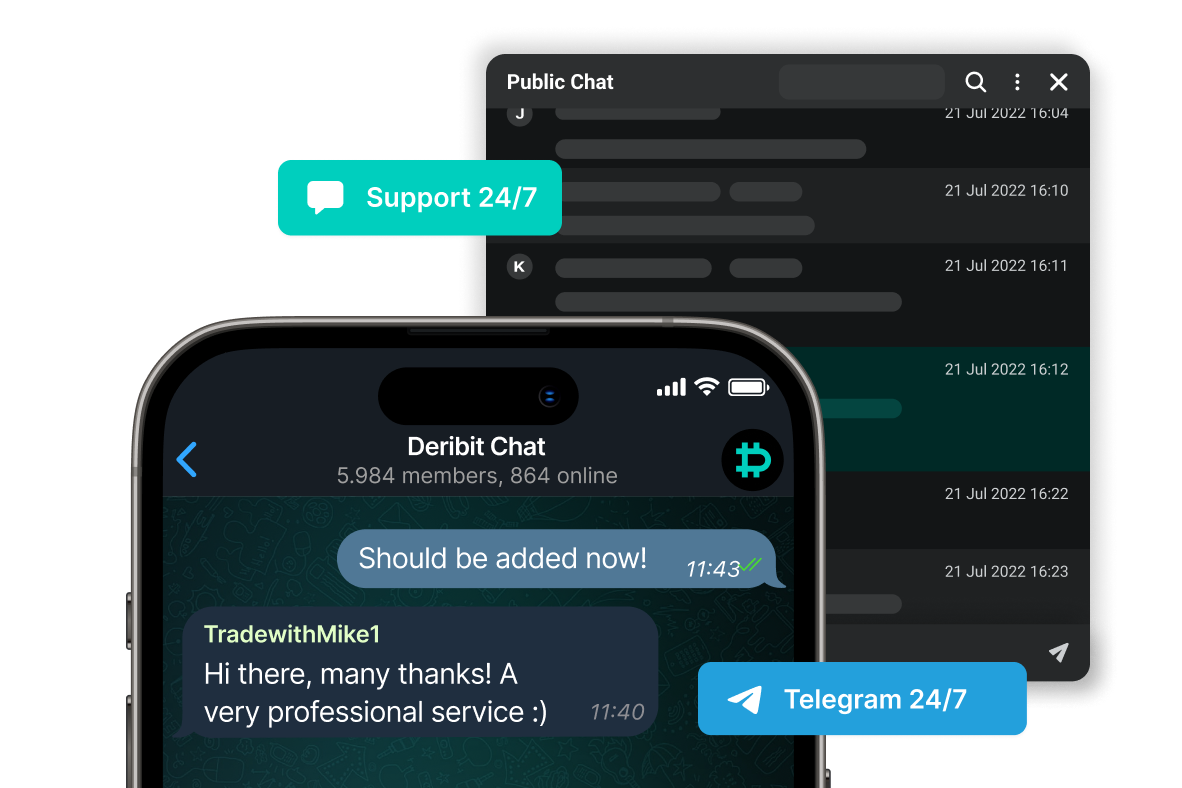

您可以学习我们的免费期权课程,快速提升交易技能,还可以使用我们的模拟交易平台体验交易,没有任何风险。如您遇到任何问题,请随时联系我们的全天候客服。Deribit将助力您开启衍生品交易之旅。

适用于有经验的交易者。

作为全球流动性最强的期权市场,Deribit为您打造机构级交易环境,向您提供业内最先进的交易工具。

适用于机构。

自2016年创建以来,Deribit一直是知名机构的青睐之选,提供LD4 Colo服务、组合保证金模式、大宗交易、组合交易以及组播等功能,拥有最好的流动性。

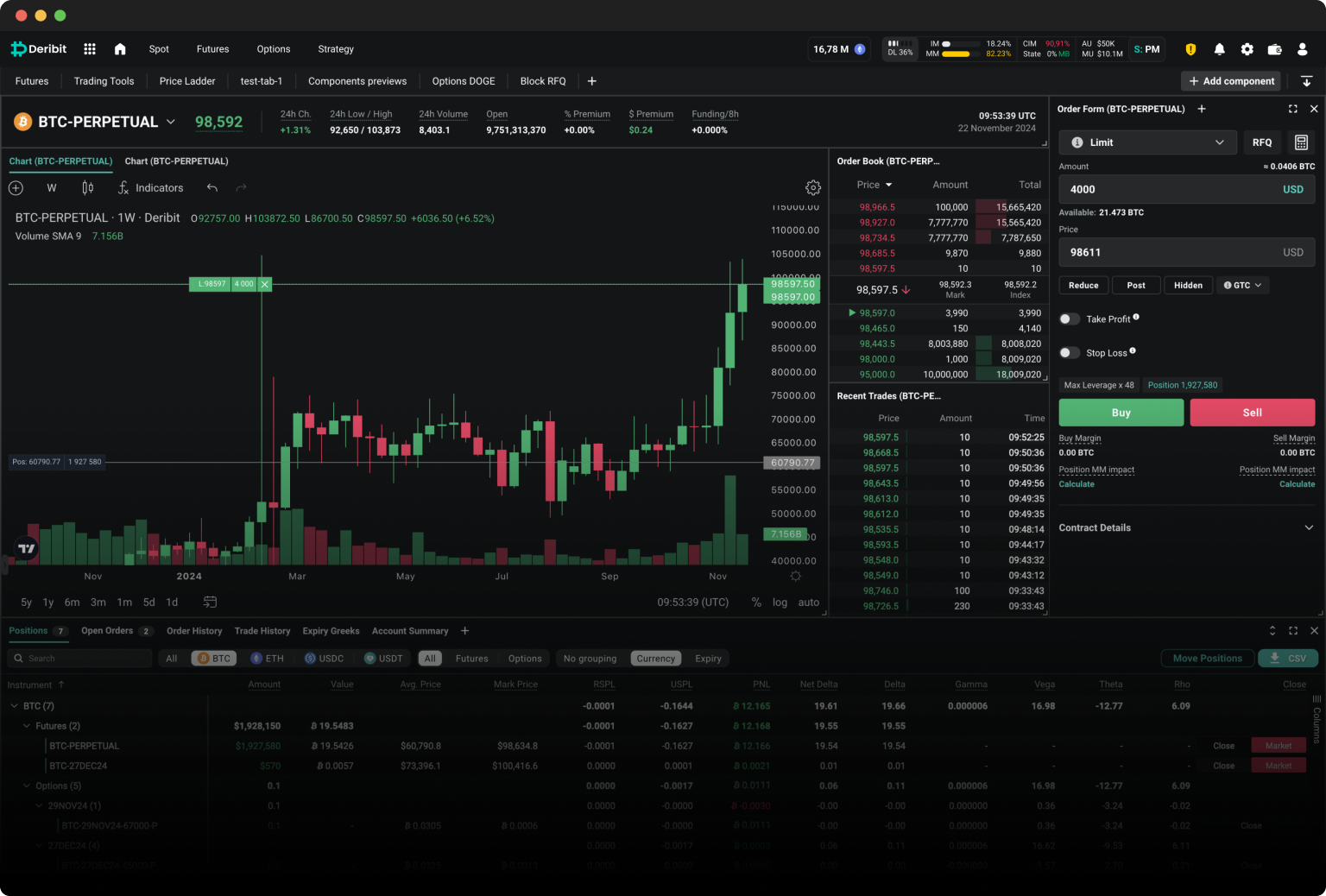

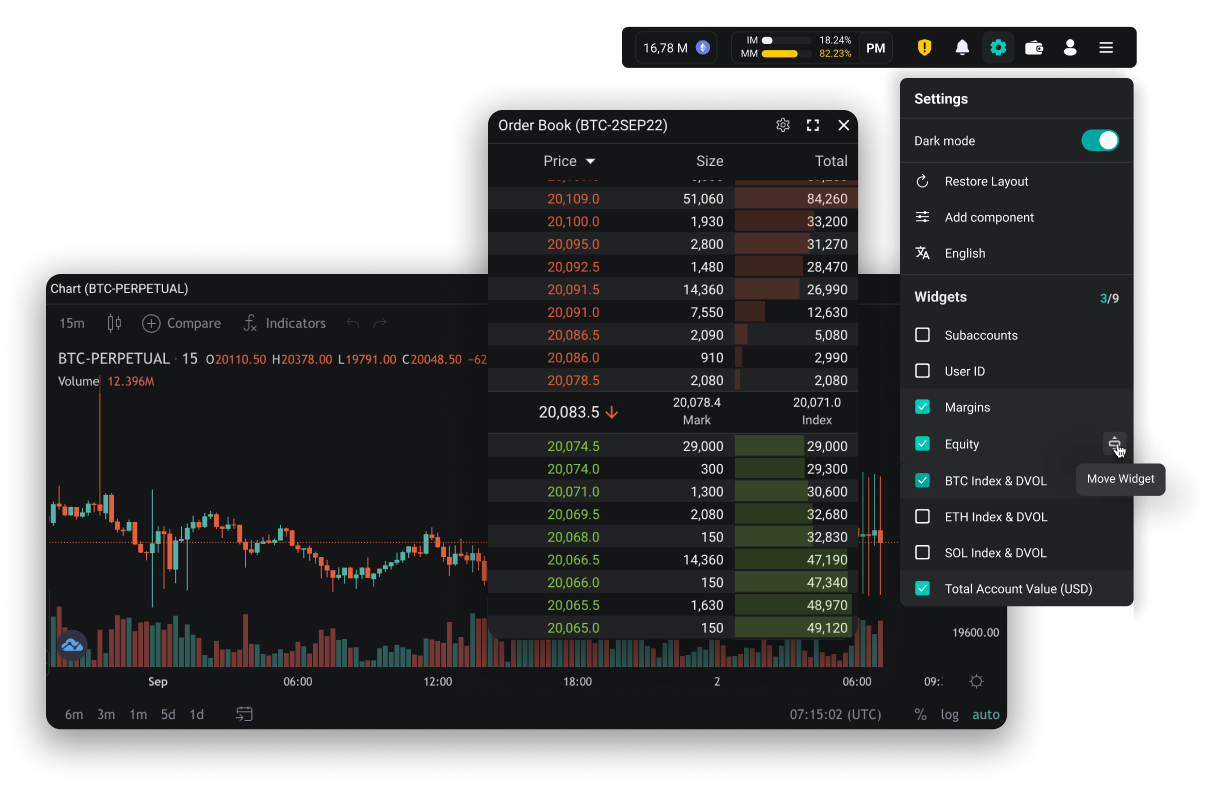

一流的用户界面。

我们的交易秘诀。

Deribit基于交易者反馈不断优化用户界面,您可以根据自身需求,拖放组件进行设置,还可以针对不同的资产、策略或多个用户创建独立的自定义交易页面,以及添加标题小部件。Deribit在可定制化程度方面设定了新标准。

开立账户

几分钟内即可开始交易

1.创建账户

几分钟内即可完成账户创建与认证。

2.充值账户

支持使用BTC、ETH或USDC充值到您的账户。

3.开始交易

依托我们所有的高级策略工具,实现交易收益最大化。

现在注册

全球最大的加密货币期权与期货交易平台。

加密货币期权市场份额

85%+

2023年交易量

$608 B

始终稳定可靠

2016年以来

FAQs

Deribit在遵守国际规则和法规的同时,尽力保持向尽可能多的国家开放交易。因此,支持国家列表会不定期更新,建议访问以下页面进行检查:受限制的国家列表

Deribit需要先完成个人验证KYC才能执行存款、提款或平台上的任何交易相关活动。一般来说,如果您已经准备好相关文件,验证只需几分钟即可完成,通过以下页面进行:验证

如果您的自动身份验证失败,请尝试上传其他文档或照片。一般来说,提高照片清晰度或更换不同的照片或文档会有所帮助。如果您不能正常使用自动验证程序,请联系compliance@deribit.com进行手动验证程序。

初始保证金

是指开仓所需的最低保证金金额。如果您超出初始保证金IM要求(在您的账户顶部显示为IM百分比栏),您将无法开立更多头寸,而如果您的IM计量表超过100%,则您未平仓的无风险减仓订单将被取消。

请注意,期货(线性、反向、永续或远期)和期权的IM计算方式不同。一般来说,IM开始时为2.0%(50倍杠杆交易)或4.0%(25倍杠杆交易),根据各个币种变量和标的币种头寸规模线性增加。您可以在此处查看详细解释:https://static.deribit.com/ les/USDCContractSpecsandmargins.pdf

维持保证金

是指维持已有仓位所需的最低保证金金额。如果您超出维持保证金MM要求(在您的账户顶部显示为MM百分比栏),您的头寸将被强制平仓,直至您的维持保证金要求恢复至100%以下,或所有涉及头寸均被强制平仓。

MM开始时为1%或2%,根据各个币种变量和标的币种头寸规模线性增加。您可以在此处查看详细解释:https://static.deribit.com/les/USDCContractSpecsandmargins.pdf

默认情况下,标准保证金模式适用于以下交易策略:

- 买入期权:

在标准保证金模式下,您的期权买入仓位不会被强制平仓 - 方向性头寸,尤其是高杠杆和无对冲仓位:标准保证金模式允许策略获得更高的杠杆

高级组合保证金此模式会综合考量期货和期权头寸,从而可能会降低整体投资组合的保证金要求。它适用于以下策略:

- 对冲头寸:

通过采用组合保证金模式,多腿交易结构或对冲头寸可以共享保证金,进而可以降低保证金要求、降低风险或采用更高的杠杆

因此,组合保证金和标准保证金模式的区别在于,组合保证金模式关注的是整个头寸组合在不断变化的市场行情下的表现。请注意,在组合保证金模式下,您的头寸保证金要求将更多地受到参数的影响,而非仅仅受到价格走势的影响。计算您的保证金要求时,系统将会按照相应的保证金模式计算投资组合可能遭受的最大损失,并以该损失金额用于保证金要求。您可以参阅以下文章了解详细解释:https://insights.deribit.com/education/portfolio-margin/

为了确保您的所有提款能够及时处理,请进行以下设置:

- 在您的账户上添加2FA设备或安全密钥设备,并确保“钱包”对应的设备设置为开启。请访问以下页面:安全

- 确保将“新地址提款延迟时间”设置为至少3天。请注意,这意味着您新添加的提币地址在指定的时间过后才可以进行提币,例如在3天设置下,新添加的地址需要在72小时后才能提币。如果将此设置改为零天,系统允许您立即激活新钱包进行提币,但是每一笔提币都会进行多次审核,造成处理进度比较慢。您可以通过以下链接设置它:提款

- 最近更改过密码或电子邮件的账户将需要额外的安全验证,因此也会出现提币较慢的情况。请备份您的密码并确保电子邮箱的安全,以防止以上情况发生。

- 请注意,只有在每日结算后(08:00 UTC)才能提取前一时段的利润,这种限制是由我们的社会化损失系统的运行规则规定的。尽管我们从未触发过此类事件,但我们始终需要对任何市场状况做好风控准备。您可以在此处了解更多信息:Deribit保险基金和社会化损失系统

Deribit接受比特币(仅支持BTC主网),以太坊(仅支持ETH主网)和USDC(仅支持ERC20网络存款)进行存款和提款。我们不支持任何其他链上存取款。生成存款地址前,需要完成KYC验证。验证成功后,您可以在“存款”页面上生成存款地址:存款

您仅可通过联系support@deribit.com重置双重身份验证器2FA或安全设备;请注意,您需要经过额外验证方可重置,且重置过程需要一定时间。我们建议在您重置双重身份验证器后新增一个备份设备或TOTP应用程序,谨防将来再次出现此类问题。

您仅可通过support@deribit.com更换邮箱。我们始终将客户安全置于首位,因此将该客服邮箱设为用户唯一的联系和授权方式,此举可防止潜在黑客攻击您的账户,使其无法轻易更换您的邮箱。

当您访问任何网站时,它可能会在您的浏览器中存储或检索信息,主要以 Cookie 的形式。该信息可能与您、您的偏好或您的设备有关,通常用于使网站按您的预期工作。该信息通常不会直接识别您,但可以为您提供更个性化的网络体验。由于我们尊重您的隐私权,您可以选择不允许某些类型的 Cookie。点击不同的类别标题以了解更多信息并更改我们的默认设置。然而,阻止某些类型的 Cookie 可能会影响您对网站的体验及我们能够提供的服务。

了解详情严格必要的 Cookie

必要的 Cookie 启用网站的核心功能,如安全性、网络管理、可访问性和页面导航。这些 Cookie 对于您使用我们的服务的功能至关重要,网站在没有这些 Cookie 的情况下无法正常运行。

_cfuvid

由 CloudFare 使用的整合 Cookie,以防止垃圾邮件机器人。

- 到期: 会话

- 类型: HTTP Cookie (第三方)

- 域: .deribit.com

cf_clearance

此 Cookie 用作 Cloudflare 安全和性能功能的一部分。

- 到期: 1 年

- 类型: HTTP Cookie (第三方)

- 域: www.deribit.com

cid

此 Cookie 用于保护用户会话。

- 到期: 1 年

- 类型: HTTP Cookie (第一方)

- 域: www.deribit.com

cookieConsent

用于了解您是否已给予 cookies 的同意。

- 到期: 持久性

- 类型: HTML 本地存储 (第一方)

- 域: www.deribit.com

cookieConsentScopes

用于记住您同意的 Cookie 类别。

- 到期: 持久性

- 类型: HTML 本地存储 (第一方)

- 域: www.deribit.com

userSettings

用于跟踪您的偏好,包括自定义页面和其他核心功能。

- 到期: 持久性

- 类型: HTML 本地存储 (第一方)

- 域: www.deribit.com

统计数据

统计 Cookie 收集有关访客如何使用我们服务的信息,例如访客最常访问哪些页面,是否收到网页错误消息。这些 Cookie 收集访问页面的汇总(匿名)数据。他们用于改善我们的服务。

_ga*

用于 Google Analytics 以正确检索使用数据。

- 到期: 2 年

- 类型: HTTP Cookie (第三方)

- 域: www.deribit.com

_pk_id*

用于 Piwik analytics 以正确索引检索的数据。

- 到期: 13 个月

- 类型: HTTP Cookie (第三方)

- 域: www.deribit.com

_pk_ref

用于存储归因信息,即最初用于访问该网站的引荐来源

- 到期: 6 个月

- 类型: HTTP Cookie (第三方)

- 域: www.deribit.com

_pk_ses*

用于记录访客查看了哪些网页的 Cookie。

- 到期: 6 个月

- 类型: HTTP Cookie (第三方)

- 域: www.deribit.com

mp_*

跟踪用户交互,以改善整体用户体验。

- 到期: 1 年

- 类型: HTTP Cookie (第三方)

- 域: www.deribit.com

营销

营销 Cookie 用于跟踪跨网站的访客。目的是向个别用户展示相关且有吸引力的广告,从而为发布商和第三方广告商带来更大的价值。

_gcl_au

该 Cookie 由 Google 广告传感器使用,以正确分类用户并展示广告。

- 到期: 持久性

- 类型: HTTP Cookie (第三方)

- 域: www.deribit.com

guest_id*

此 Cookie 由 Twitter 设置,用于识别和跟踪网站访客,以便进行市场分析。

- 到期: 2 年

- 类型: HTTP Cookie (第三方)

- 域: .twitter.com

muc_ads

用于通过跟踪用户在网站上的行为来增强广告相关性。它收集数据以显示更个性化和引人入胜的广告,典型寿命为 400 天至 2 年。

- 到期: 1 年

- 类型: HTTP Cookie (第三方)

- 域: .t.co

personalisation_id

Twitter 通过一系列插件和集成收集数据,主要用于跟踪和定位。

- 到期: 1 年

- 类型: HTTP Cookie (第三方)

- 域: .twitter.com

本网站使用Cookie以确保您获得最佳体验。了解详情